Financial Fitness Workouts

From PEN-Powered Activity Guide VIII: Supporting Your Support System

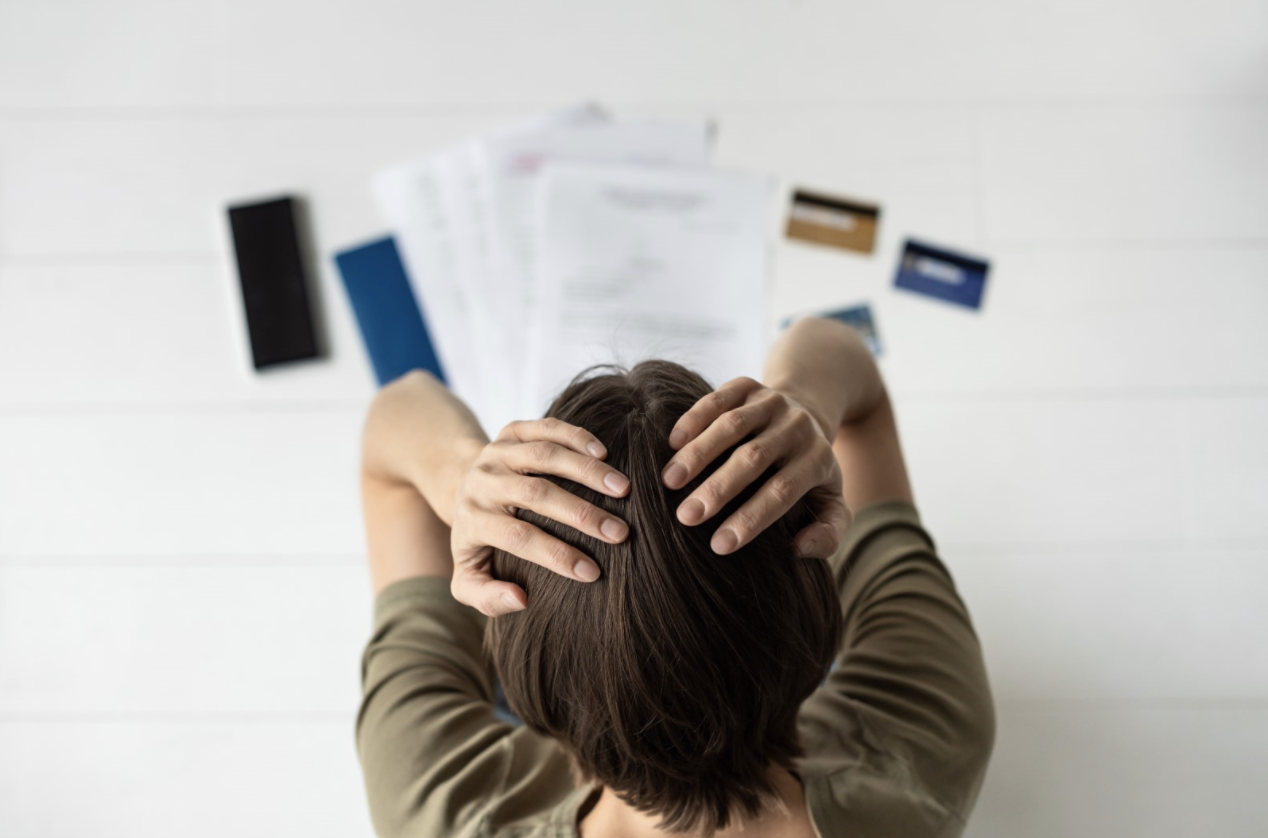

It seems every day we’re being bombarded with ways to stay fit. there is always a new fitness program or a new types of fitness equipment that’s supposed to give us the best bodies we can have. But with those who are dealing with a chronic illness, fitness takes on a different meaning. Not only do we need to feel our best physically, we also must be prepared in every aspect of our lives with your sight always set on your best possible treatment and your continuum of care.

I thought this would be a great time to review four of the most impactful areas you can review, reallocate, and make the changes that are most appropriate for your specific circumstance.

A good way to look at it is, in the fall we make sure we perform maintenance checkups or in our furnaces. We prepare our gardens and lawns for the upcoming spring, we check the exterior for homes for energy efficiency and we do checkups on our cars to prepare them for the winter season.

Unfortunately, few of us take the time to review the foundations of our financial lives that in fact dictate our ability to remain on treatment plans and meet all of our financial obligation. It is my hope, that everyone takes the opportunity to review at least these four areas that I’m covering in this article before the end of the year.

Medicare

First, the big one for a lot of us, Medicare. As you know the Medicare season is almost upon us. And there are changes as there are every year. If you are already a Medicare enrollee, this open enrollment period gives you the opportunity to make changes if needed. And if you have been enrolled for 12 months or less and you have a Medicare Advantage plan you even have the opportunity to replace it with a Supplemental plan perhaps with guarantee issue If you qualify. Here may be a wait period but you may not be able to get in at a later date and the coverage may be better for you.

Also, if you have an HMO plan you may be able to switch to a PPO for more plan flexibility. Review your Prescription formulary if there have been changes to your treatment. The worst thing you can do is to not review your Medicare options as there are changes every year and more plans may be available to you and the cost may be better as well. Don’t assume that the cheaper the premium the better off you are. Review your total cost. That includes the premium, co-pays, deductibles, coinsurance, and the cost of your meds as well.

Life Insurance

Secondly, review your life insurance plan. Many people aren’t aware of the benefits that insurance offers. Such as, accelerated benefit riders in the event you need access to some cash or the options of taking a loan from your policy.

Additionally, if you are still employed, on your next enrollment period with your employer see if you can add or increase your life insurance amounts. Even if you plan to retire or terminate your employment next year or at a later date the cost to take life insurance with your employer may be the only place you qualify without medical underwriting and it’s much cheaper. Also, see if your employer offer a supplemental life insurance that you can enroll in that may be portable at your termination from employment.

Review your credit to make sure there isn’t anything on it that’s incorrect. If you anticipate making a big purchase this will really affect your interest rate.

Monthly Statements

Third, as a financial advisor, I found a lot of clients would not look at their monthly statements to see how their retirement accounts such as 401k’s and investment accounts were doing. You are doing yourself a huge favor if you keep up with these no matter if the market is up or down. Speak to your financial advisor to make sure you’re taking advantage of growth, income producing, and tax efficient opportunities.

Financial Assistance

And finally, don’t assume you won’t qualify for financial assistance. The cost of treatment is expensive and probably always be. Talk to your doctor or social worker to help you uncover sources that can help you pay for co-pay, deductibles, coinsurance and other needs.

Do this before you find yourself in a financial crisis. Be proactive with understanding your illness and the anticipated change in treatments that may be available for you.

Instead of waiting for spring cleaning, take the time to do a financial review now. Go into the new year in the best possible position you can. And then, like getting a check-up on your car, do the same for your financial future every year. After all, you are worth more than a car!!

Diahanna Vallentine, BCPA, Financial Empowerment Lead

In 2002 Diahanna and her husband received the news that her husband had MGUS, a precursor to Multiple Myeloma. Upon her husband death in 2013, Diahanna immediately decided to make it her mission to help patients and caregivers empower themselves to speak up and to position themselves as partners in their treatment. Diahanna became a Board-Certified Patient Advocate. She is currently the Financial Myeloma Coach for The Myeloma Crowd Foundation.